As your business expands it’s likely you’ll need to hire new employees. While this is an exciting step in your business, it’s important to understand the relevant employment laws and regulations to ensure your payroll processes are correct and staff are happy.

Before you begin hiring new employees, there are some common pitfalls you need to avoid:

Failing to provide a written statement of employment

All employees in the UK must be presented with a written statement of employment within their first 2 months. This must include the main conditions of employment, job title, how much the employee will be paid, hours of work, holiday time, collective agreement and pension information.

In Northern Ireland, disciplinary rules must also be included in the written statement.

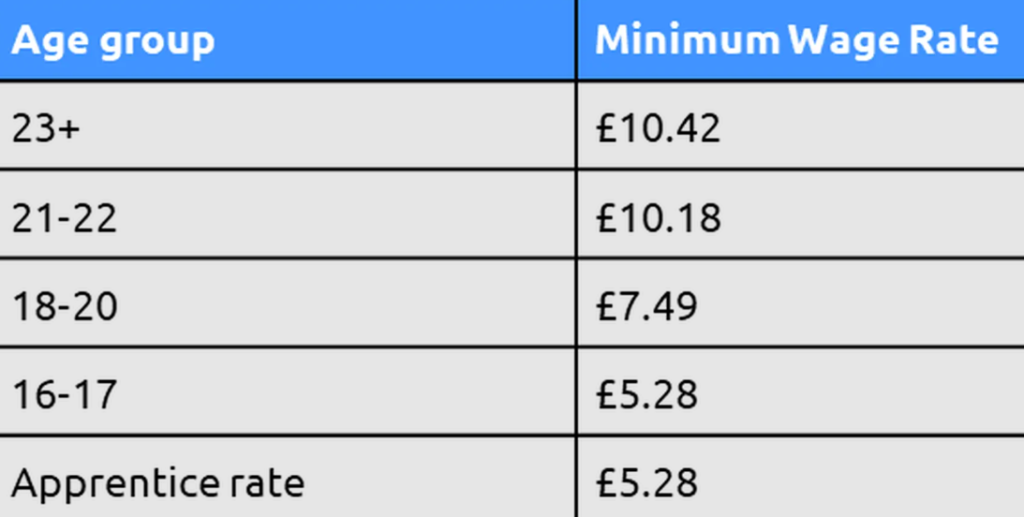

Not paying employees the required National Minimum Wage

Minimum wages differ among age groups, and if their requirements aren’t met or exceeded employers can be fined or lose staff due to discrepancies and inconsistencies in pay.

The current minimum wages for 2023 in the UK are:

To learn more about how much a new employee can cost your business, read our blog.

To learn more about how much a new employee can cost your business, read our blog.

Neglecting to inform HMRC of a new employee

All employers must inform HMRC of new employees joining their business. Failure to do so can lead to penalties and fines.

To stay compliant, companies will need to submit a Full Payment Submission (FPS) report to HMRC. The submission contains information on your staff member like their tax code, any pay and deductions and the employees unique payroll ID.

If any of the details are incorrect it can lead to payroll mistakes, so it’s vital that all of the information you submit is accurate. Obviously as a business you want to avoid making any payroll mistakes to reduce the need to pay any fines, penalties or face business closure.

Getting your payroll right can have huge impacts on employee satisfaction, productivity and motivation, helping your business thrive and build a positive company culture. To learn more about how you can boost employee satisfaction, read our blog on how getting the basics right can improve employee satisfaction.

Making incorrect Auto-enrolment payments

Auto-enrolment is when an employee meets certain requirements and is automatically made a member of a workplace pension scheme without needing to opt in.

Since 2012, people no longer need to choose whether they want to be a part of their company’s pension scheme. As a result of this change more people are able to build up their savings to help provide them with income after they reach 55.

Those that can be automatically enrolled need to meet the following requirements:

● They work in the UK, including seafarers residing in the UK

● They aren’t already in a suitable workplace pension scheme

● They’re at least 22 years old and are under state pension age

● They earn more than £10,000 a year for the tax year 2023/24

It’s important to remember that even if an employee is eligible for your workplace pension scheme, they do have the right to opt out.

To avoid these pitfalls when hiring new employees and stay compliant with the latest rules and regulations, you can use payroll software to help you make tasks easier through automating tasks and integrating HR and time and attendance softwares.

Here at Payescape, our payroll experts ensure compliance, stay on top of the latest rules and regulations and make sure your employee payroll and pension payments are accurate and on time.

To learn more about how we can help you avoid the pitfalls of hiring new employees, get in touch with us today.