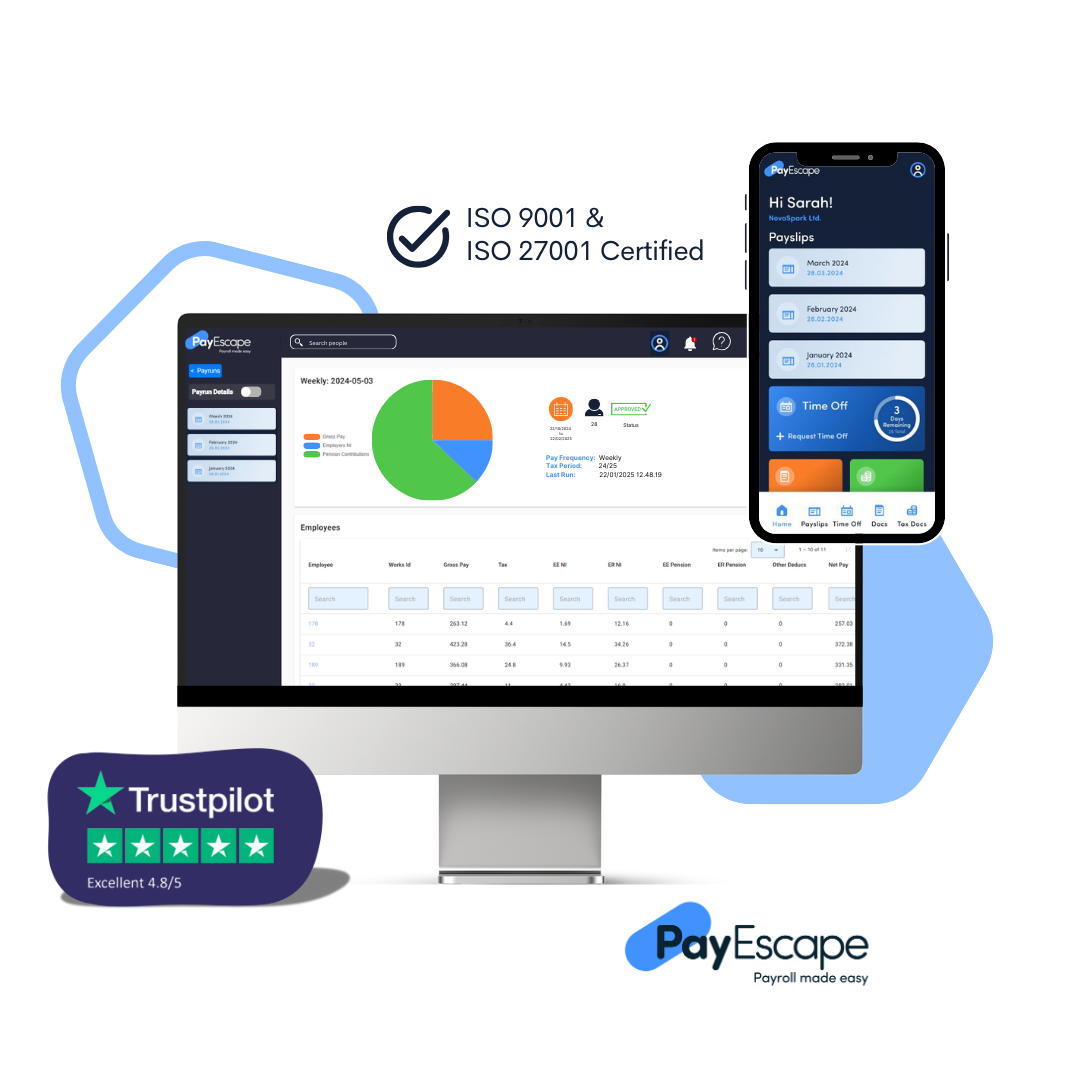

Payroll Service Provider

Payroll services designed to save you time, reduce errors, and keep your business compliant. Our payroll services take the pressure off your internal teams by ensuring every aspect is handled accurately and efficiently. With automated processes and expert support, we help you avoid costly errors and streamline your business operations.