Discuss Pricing, Start Your Journey

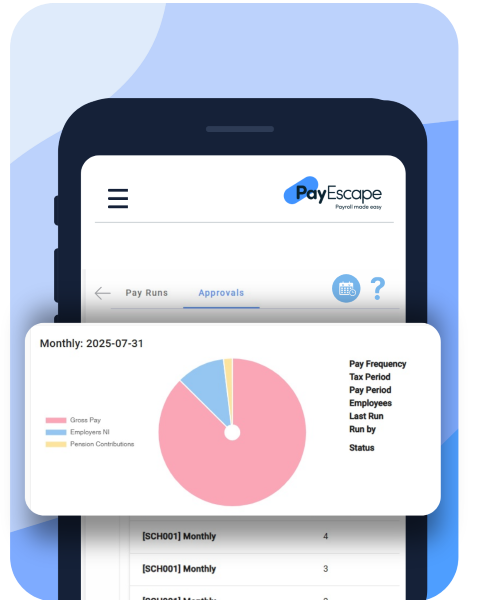

Save time and money with PayEscape, book a demo today and get started on your cloud-based journey. Thousands of businesses across the UK choose our cloud-based software and services to manage their Payroll, HR and Time Management. Supported by our CIPP and CIPD expert teams we provide true end to end solutions.