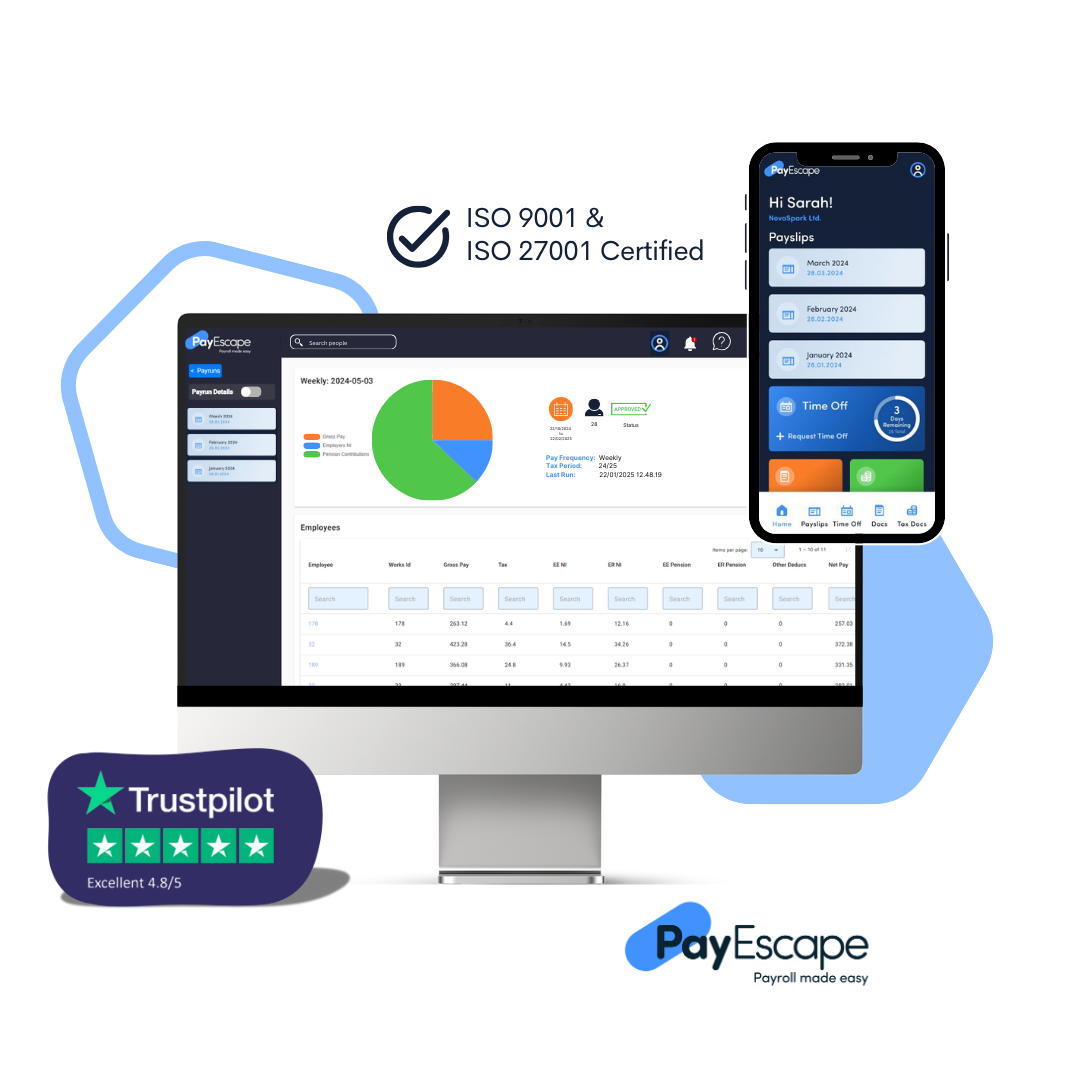

Industry payroll services

Payroll software is important to every business, no matter the size or industry. If you are a large-scale business currently handling in-house payroll, you may want to consider outsourcing your payroll or opting for a fully managed service to help stay compliant, ensure timely staff payments, and manage sick or holiday requests.